The Value of a Secure Identity: Deconstructing the IAM Market Value

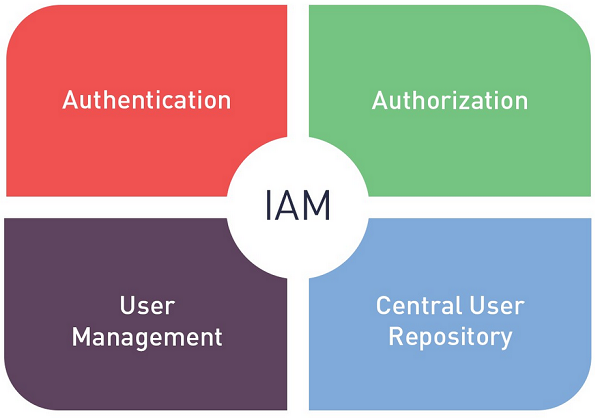

The economic significance of software and services designed to manage and secure digital identities has grown into one of the largest and most critical segments of the global cybersecurity market. The Identity and Access Management Market Value is a massive figure, measured in the tens of billions of dollars annually, and it continues to grow at a rapid pace. This valuation is the aggregate of worldwide spending on the complete ecosystem of IAM solutions and services. It is primarily composed of the recurring revenue from subscriptions to cloud-based Identity-as-a-Service (IDaaS) platforms, as well as the revenue from on-premise software licenses, maintenance contracts, and extensive professional services. The market's immense monetary value is a direct reflection of the massive financial and reputational costs of a data breach, which in a majority of cases, originates from a compromised identity or credential.

The primary source of this market value is the revenue generated from the IAM software platforms themselves. The market is increasingly dominated by a subscription-based model, which provides vendors with a stable and predictable recurring revenue stream. This includes the subscription fees for comprehensive, cloud-native IDaaS platforms from vendors like Okta and Ping Identity, which provide a full suite of authentication and access management services. It also includes the substantial revenue generated by Microsoft from its Azure Active Directory (now Entra ID) platform, which is bundled with many of its popular Microsoft 365 enterprise licenses, giving it a massive and captive user base. While sales of traditional on-premise software from vendors like Oracle and Broadcom still contribute, the cloud subscription model is the primary driver of the market's value and growth.

The justification for this colossal global spending is rooted in a powerful and multifaceted return on investment (ROI) calculation. The most critical ROI comes from risk reduction and breach prevention. The cost of a major data breach can run into the millions or even tens of millions of dollars, including regulatory fines, legal fees, and customer remediation costs. A modern IAM platform, with its strong multi-factor authentication and Zero Trust access controls, is one of the most effective ways to prevent the account takeover attacks that lead to these breaches. The ROI is also driven by significant operational efficiency gains. Automating the processes of user onboarding, offboarding, and access requests through an Identity Governance platform can save thousands of hours of manual IT work. Finally, by providing a seamless Single Sign-On (SSO) experience, IAM improves employee productivity and satisfaction.

The impressive and growing market value has also created a highly active and strategic M&A and investment landscape. The identity market is seen as the cornerstone of modern security, and this has made it a hotbed of activity. There has been massive consolidation, highlighted by Okta's multi-billion dollar acquisition of its competitor Auth0, and a constant stream of smaller acquisitions by all the major players as they race to build the most complete identity platform. Private equity firms are also heavily invested in the space. At the same time, venture capital continues to pour into innovative startups that are focused on new areas like decentralized identity, machine identity management, and passwordless authentication. This continuous cycle of massive investment and strategic acquisition is a clear validation of the market's high value and its central role in the future of cybersecurity.

Other Exclusive Reports:

Enterprise Data Warehouse Market

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness